In the middle of a global economic recovery, around the world, hundreds of shop chains and shopping centres are closing. FIB decided to find out what’s really going on.

From rural shopping centres to Manhattan’s famous avenues, it has been a disastrous two years for retail. In the first four months of 2017 there have been nine retail group bankruptcies in the USA —as many as all of 2016. J.C. Penney, RadioShack, Macy’s, and Sears have each announced more than 100 store closures. Sports Authority has liquidated, and Payless has filed for bankruptcy.

A few weeks ago, several apparel companies’ stocks hit new multi-year lows, including Lululemon, Urban Outfitters, and American Eagle, and even fashion titan Ralph Lauren announced that it has been forced to sell off its flagship Polo store on Fifth Avenue, one of several brands to abandon that iconic thoroughfare.

Around the world right now many designer brands are searching for ways to stay relevant. Jimmy Choo, the luxury shoe company, recently announced that it is up for sale. JAB Holding, a German consumer goods company, acquired the brand in 2008 for $800 million and took it public in 2014, retaining a 67.6% stake. JAB has recently been investing in American coffee brands and is about to buy Panera, the sandwich chain. These investments hinge on the broader trend of consumers choosing to spend money on experiences rather than luxury goods.

Giorgio Armani is another fashion legend who is looking for ways to cut costs. Strange times indeed. At the designer’s manufacturing plant Giorgio Armani Operations in Settimo Torinese, about 83 miles East of Milan, 110 employees are expected to be laid off out of a total 180. The company is specialised in manufacturing men’s jackets and coats. Armani is the latest in a string of designers and companies that have streamlined collections and costs, including Ralph Lauren, Burberry, Marc Jacobs, Dolce & Gabbana and Paul Smith.

In Australia the recent collapse of national fashion brands Marcs and David Lawrence added another 1130 workers to the retail rout that claimed close to 2000 jobs in the sector before Christmas of 2017. In addition, retail insiders claim the rot that took down Australian chain Payless Shoes and Pumpkin Patch in December 2016 has spread to Australia’s upmarket, national fashion chains and warn of more pain to come.

Australian Retail Analyst Steve Kulmar said, “We’ve heard a lot about tier-three brands getting into trouble but now it’s moved into better known national brands”.

Veteran Australian retail group Oroton was another Australian name to post a ‘disappointing’ 52pc slide in half year profit recently, detailing a tumultuous end to 2016, with first-half sales tumbling over 10 per cent and profit halving.

Former David Jones boss Paul Zahra said the growth of online retail along with the rise of international players such as Zara would drive “ongoing consolidation in the fashion industry and retail more broadly.” Mr Zahra, who is now global retail adviser for PwC said Australia used to be “the last horizon for international players” but this was no longer the case.

“To be successful retailers need three things, they must be omni-channel, a global entity, and they need a unique point of difference,” Mr Zahra said. “Australian retailers that don’t tick these boxes are leaving themselves wide open to disruption.”

‘Disruption’ being a polite word for extinction.

A deep recession might explain an extinction-level event for large retailers. But Global GDP has been growing for eight straight years, petrol prices are low, unemployment is under 5 percent.

So, what the heck is going on? The reality is that overall retail spending continues to grow steadily, if a little meagerly. But several trends—including the rise of e-commerce, the over-supply of malls, and the surprising effects of a restaurant renaissance—have conspired to change the face of global retail.

Here are three explanations for the recent demise of well known retail chains around the world.

1. People are simply buying more stuff online than they used to.

Taking the US example, the simplest explanation for the demise of brick-and-mortar shops is that Amazon and others like it are eating retail. Between 2010 and last year, Amazon’s sales in North America quintupled from $16 billion to $80 billion. Sears’ revenue last year was about $22 billion, so you could say Amazon has grown by three Sears in six years. Even more remarkable, according to several reports, half of all U.S. households are now Amazon Prime subscribers. And then there are the local equivalents of Amazon like China’s Alibaba etc.

But the full story is bigger than Amazon. Online shopping has done well for a long time in media and entertainment categories, like books and music. But easy return policies have made online shopping cheap, easy, and risk-free for consumers in apparel, which is now the largest e-commerce category. The success of start-ups like Farfetch, Casper, Bonobos, and Warby Parker (in clothes, mattresses, and glasses, respectively) has forced physical-store retailers to offer similar deals and convenience online.

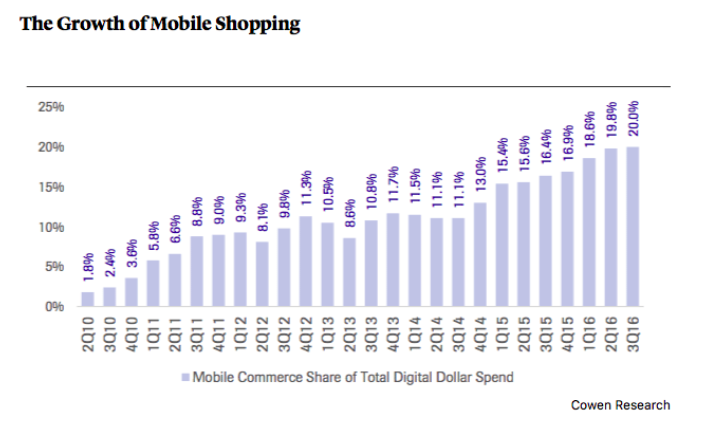

What’s more, mobile shopping, once an agonising experience of typing private credit-card digits in between pop-up ads, is getting easier thanks to apps and mobile wallets. Since 2010, mobile commerce has grown tenfold, from 2 percent of digital spending to 20 percent.

The Growth of Mobile Shopping

People used to make several trips to a store before buying an expensive item like a couch. They would go once to browse options, again to narrow down their favourites, and again to finally pull the trigger on a blue velvet love seat. On each trip, they were likely to make lots of other small purchases as they wandered around. But today many consumers can do all their prep online, which means less ambling through shopping centres and making for less impulse purchasing at adjacent stores.

But there will always be a place for physical stores. People like surveying glitzy showrooms and running their fingers over soft fabrics. But the rise of e-commerce not only moves individual sales online but also builds new shopping habits, so that consumers gradually see the living room couch as a good-enough replacement for their local mall.

So just like G-Star expect fewer but better stores, and an amazing online E-commerce offering, that packages marketing, slick engaging content with amazing fulfilment.

2. Too Many Shopping Centres.

There are about 1,200 shopping malls in America today. In a decade, there might be about 900. That’s not quite the “the death of malls.” But it is decline, and it is inevitable.

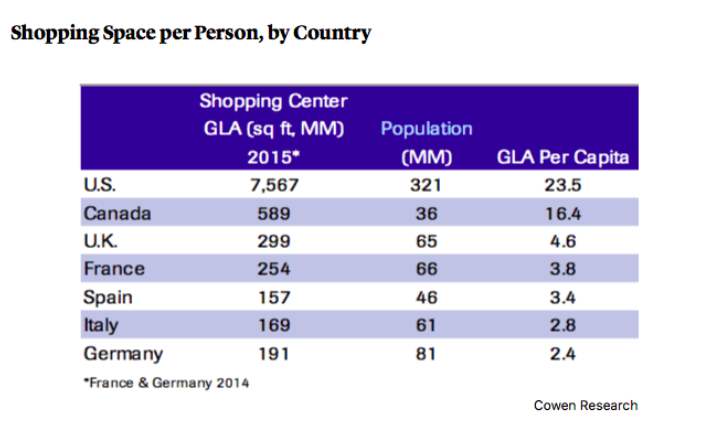

The number of malls in the U.S. grew more than twice as fast as the population between 1970 and 2015, according to Cowen Research. By one measure of consumerist plentitude—shopping center “gross leasable area”—the U.S. has 40 percent more shopping space per capita than Canada, five times more the the U.K., and 10 times more than Germany. So it’s no surprise that the Great Recession provided such a devastating blow: Mall visits declined 50 percent between 2010 and 2013, according to the real-estate research firm Cushman and Wakefield, and they’ve kept falling every year since.

In a long and detailed paper this week on the demise of stores, Cowen Research analysts offered several reasons for the “structural decay” of malls following the Great Recession. First, they said that stagnating wages and rising health-care costs squeezed consumer spending on fun stuff, like clothes.

Second, the recession permanently hurt logo-driven brands, like Hollister and Abercrombie, that thrived during the 1990s and 2000s, when coolness in high-school hallways was defined by the size of the logo emblazoned on a polo shirt. Third, as consumers became bargain-hunters, discounters, fast-fashion outlets, and club stores took market share from department stores, like Macy’s and Sears.

Finally, shopping centres are retail bundles, and when bundles unravel, the collateral damage is massive. (For example, look at pay TV, where ESPN has bled millions of subscribers in the last few years as one of its key demographics, young men, abandoned the cable bundle that is critical to ESPN’s distribution.)

In retail, when anchor tenants like Macy’s fail, that means there are fewer Macy’s stragglers to amble over to American Eagle. Some stores have “co-tenancy” clauses in malls that give them the right to break the lease and leave if an anchor tenant closes its doors. The failure of one or more department store chains can ultimately shutter an entire mall.

3. Food vs Fashion Retail.

Even if e-commerce and overbuilt shopping space conspired to force thousands of retail store closings, why is this meltdown happening while wages for low-income workers are rising faster than any time since the 1990s?

First, although rising wages are obviously great for workers and the overall economy, they can be difficult for low-margin companies that rely on cheap labor—like retail stores. Cashiers and retail salespeople are the two largest job categories in the country, with more than 8 million workers between them, and the median income for both occupations is less than $25,000 a year. But recently, new minimum-wage laws and a tight labour market have pushed up wages for the poorest workers, squeezing retailers who are already under pressure from Amazon.

Second, clothing stores have declined as consumers shifted their spending away from clothes toward traveling and dining out. Before the Great Recession, people bought a lot of stuff, like homes, furniture, cars, and clothes, as retail grew dramatically in the 1990s. But something big has changed. Spending on clothes is down—its share of total consumer spending has declined by 20 percent this century.

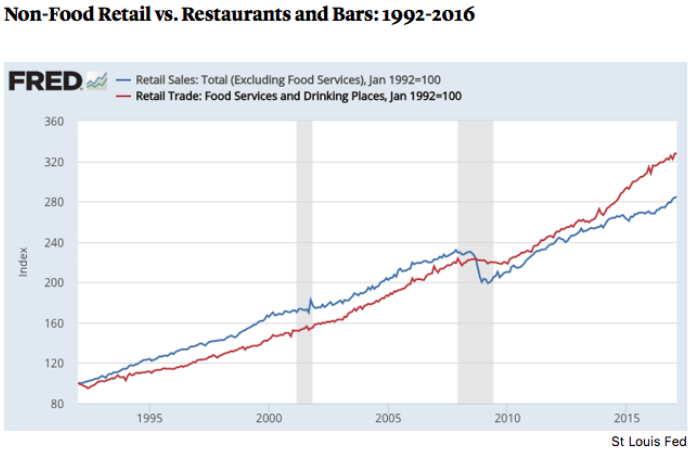

What’s up? Travel is booming. Hotel occupancy is booming. Domestic airlines have flown more passengers each year since 2010, and last year U.S. airlines set a record, with 823 million passengers. The rise of restaurants is even more dramatic. Since 2005, sales at “food services and drinking places” have grown twice as fast as all other retail spending. In 2016, for the first time ever, Americans spent more money in restaurants and bars than at grocery stores.

If you are in a cool restaurant and there are Millennials and you are bound to observe a new ritual. When their food arrives before the dig in, there is the obligatory phone photo shoot. Many young people are driven by the experiences that will make the best social media content—whether it’s a conventional beach pic or a well-lit plate of glistening avocado toast. Laugh if you want, but these sorts of questions—“what experience will reliably deliver the most popular Instagram post?”—really drive the behaviour of people ages 13 and up. This is a big deal for malls, says Barbara Byrne Denham, a senior economist at Reis, a real-estate analytics firm. Department stores have failed as anchors, but better food, entertainment, and even fitness options might bring teens and families back to struggling malls, where they might wander into brick-and-mortar stores that are currently at risk of closing.

There is no question that the most significant trend affecting brick-and-mortar stores is the relentless march of Amazon and other online retail companies. But the recent meltdown for retail brands is equally about the legacy of the Great Recession, which punished logo-driven brands, put a premium on experiences (particularly those that translate into social media moments), and unleashed a surprising golden age for restaurants.

Finally, a brief prediction. One of the mistakes people make when thinking about the future is to think that they are watching the final act of the play. Mobile shopping might be the most transformative force in retail today. But self-driving cars could change retail as much as smartphones. Once autonomous vehicles are cheap, safe, and plentiful, retail and logistics companies could buy up millions, seeing that cars can be stores and streets are the ultimate real estate, kind of the way Food Trucks have become mobile restaurants.

In fact, self-driving cars could make shopping space nearly obsolete in some areas. CVS could have hundreds of self-driving minivans stocked with merchandise roving the suburbs all day and night, ready to be summoned to somebody’s home by smartphone.

A new luxury brand in 2025 might not spring for an Upper East Side storefront, but maybe its autonomous showroom vehicle could circle the neighbourhood, waiting to be summoned to the doorstep of a luxury apartment building. Autonomous retail will create new conveniences and traffic headaches, require new regulations, and inspire new business strategies that could take even more businesses out of the commercial real estate.

The future of retail could be even weirder yet. One thing for certain is that it will be nothing like it used to be.