Hi, I’m Paul Roberts welcome to my PODCAST Channel “THE FUTURE” where I cover BREAKING TRENDS FROM AROUND THE WORLD

In our ever accelerating times, keeping ahead of the latest breaking news and trends from the world’s of fashion, music, film, art, tech, activism, is a time consuming daily challenge. Sure the information is all out there, but it is a time consuming ordeal to scan all the necessary sources. As Darwin said survival depends on how quickly you can adapt.

The future belongs to those who prepare today.

In this PODCAST #110, I want to talk about how COVID-19 is rewiring our spending and savings habits.

It remains to be seen if frugality will become cool, but the coronavirus quarantine is already altering consumer demands and expectations.

Last week in Australia we got the news that the denim based fashion brand Gstar Australia was placed into receivership. Granted this was not the Amsterdam billion dollar brand that failed but rather just the Australian retail business which had 57 stores around the country, but nonetheless when market conditions are enough to make a power denim business fail, you have to wonder who is next. Retail is the largest single employer in Australia and probably the world, and this is an ominous sign for the things to come. Walk around any Westfield fashion precinct and you have to think, that if a brand like Gstar can fail, then the Dominos are lined to follow.

As a consumer society, we are conditioned to be acquisitive. Sophisticated marketers know how to segment markets. Consumers are often grouped into discreet segments that share common characteristics. Luxury, value for money, functionality, price. Some products are sold through their image of status, some by a carefully crafted image, some by anti status. Whatever the pitch, the goal is the same, to keep buyers wanting more. And the emphasis on the wanting, rather than the needing.

We collect sneakers, we collect handbags, we collect cars. New is great, and more is better. Bigger is best. But when faced with real challenges, purchasing reverts to the bottom end of Maslow’s hierarchy: food > shelter > safety health, and we are left to reevaluate what really is enough–from our money to our activities to our stuff.

And now in the midst of the Corona reset it will be interesting to see how the role of spending and saving plays out.

Some pundits are predicting a wave of ‘revenge spending’ by the wealthy, others are less bullish about such a return.

In the U.S., 70% of the GDP is made up of consumer spending. Everyday purchases, large and small, drive value for the economy and the markets. And right now, our everyday purchases are being significantly curtailed by quarantine, income instability, and–for tens of millions of people–unemployment.

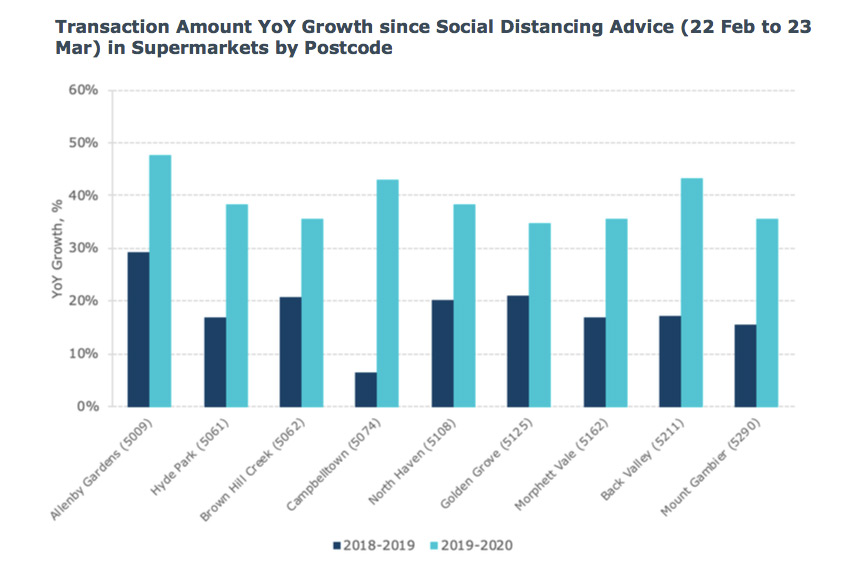

Even for those lucky enough to still be on a salary, spending patterns have changed significantly. Spending is up at grocery stores and for some home goods, and it’s down pretty much everywhere else. New lifelong habits can be formed in a few short months.

As some of us approach that new-habit milestone in our strange new normal, we are faced with two real-time questions:

- Will these changes be permanent by circumstance or by choice?

- And, in our consumption-driven society, how much, really, is enough?

WHAT IS ENOUGH

In a post-COVID-19 world, will the people who paid hundreds of dollars for gyms be okay with running outside in the long term? Will the restaurant-loving foodie who once used their fridge for booze and nail polish storage continue with their newfound cooking skills and eat at home more? Will avid moviegoers be okay with streaming content instead of regular multiplex visits?

Money: For many, the current societal and economic crisis may have been the first time they took a good hard look at their finances: what’s coming in, what’s going out, and how much is in savings. One habit worth keeping is putting away extra money, spending within a budget, and taking an active role in our financial future.

Material Possessions: It would seem that the tired stereotype of the broke millennial who values meaningful experiences over the “stuff” of traditional consumption may actually be the new normal.

It remains to be seen if frugality will become cool. Or if luxury goods will become redundant. Or if conspicuous consumption will be reviled. And it remains to be seen if the answer to “How much is enough?” will continue to evolve.

This is not just about consumption. Our expectations of service providers may have changed for the long term as well. Take banks, for example. Given that a significant proportion of bank branch visits before COVID-19 were to deposit a single cheque, will there be a role for the branch moving forward beyond being financial intermediaries?

Now, more than ever, we need financial institutions to advocate for us, to help us delay obligations if we can’t meet them, and to process loans quickly for our small businesses. These newfound advocacy muscles will come in handy in the coming weeks and months.

Beyond banking, our higher expectations will likely extend to demand that our grocery stores and restaurants continue to offer curbside pickup and that our medical providers continue to provide telehealth at scale. Necessity is the mother of innovation, and there’s a whole lot of necessity right now.

COVID-19 will likely have a significant impact on our long-term spending and saving habits as we take a hard look at what’s really enough. If history teaches us anything, we will likely see larger societal changes that will impact every facet of our life as we navigate the new normal.

FIB Trend Reports:

Charles Darwin said “It Is Not the Strongest of the Species that Survives But those Fastest to Adapt”

If you want to want to know where your world is headed first subscribe to the FIB Platinum Content Membership.

FIB’s Platinum Content Membership is a revolutionary new service that provides our members an unlimited rights free use of our extensive Content library. Never before has such a resource been made available rights free to allow people to dominate in their Content marketing, and never at such an unbelievable low annual fee.

CLICK THE LINK BELOW to SUBSCRIBE TO OUR FIB PLATINUM ANNUAL MEMBERSHIP SO YOU CAN GET ACCESS TO ALL OUR CONTENT AND FILMS.

If you like this Podcast please share and write a review. See you next time. Paul

https://desiregroupe.samcart.com/products/fibs-content-licence